arizona estate tax laws

The majority of statutes relating to property tax are referenced in Title 42 Taxation. Statutes are laws passed by the Arizona Legislature.

Tax Law And Policy Concentration University Of Arizona Law

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return.

. Even though Arizona does not have its own estate tax the federal government still imposes its own tax. Additionally states levy extra taxes on items such as liquor tobacco products and gasoline. Arizona trustees must file a federal estate tax return for any trust valued at more than one million dollars.

The Estate Tax was levied on the net estate of every decedent at the following. In this case it is known as a small estate. State revenues are comprised of property taxes sales tax and certain taxes on businesses.

There is one exception to this rule which is for estates with personal property valued at less than 75000 and real property under 100000. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the following. The federal estate tax applies to all estate that exceeds the exemption level of 1206 million.

Heres what your need to know about whats. In the absence of a will state probate court decides. THIS TITLE HAS BEEN REPEALED.

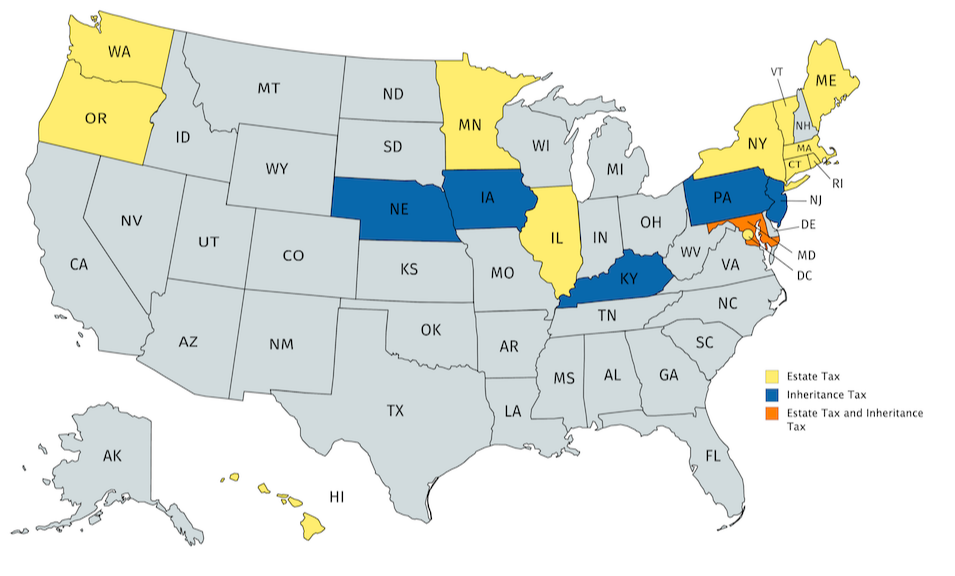

Chapter 11 - Property Tax. The inheritance and estate taxes for Arizona residents. Many times however those with large estates have used tools to.

Laws 1937 Chapter 27 repealed the Arizona Inheritance Tax and authorized the Arizona Estate Tax in its place. In Arizona as in other states ones estate is inherited by friends relatives or other beneficiaries according to the details in the written will. Arizona has passed an historic tax reform package that changes our tax code reduces income taxes and benefits everyone.

Entire Arizona Revised Statutes. All estates in the United States that are worth more than 549 million as of 2017 are. Federal law eliminated the state death tax credit effective January 1 2005.

What Is A Real Estate Transfer Tax And Do I Have To Pay It In Arizona Law Office Of Laura B Bramnick

Estate Planning Lawyer Chandler Arizona Citadel Law Firm

State Estate And Inheritance Tax Treatment Of 529 Plans

Is There An Inheritance Tax In Arizona

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Estate Planning Lawyer In Mesa Chandler Az Phelps Laclair

Do You Report Income Tax On An Inheritance In Arizona

Is There An Inheritance Tax In Arizona

Inflation Reduction Act Signed Into Law Climate Health Care And Tax 2022 Articles Resources Cla Cliftonlarsonallen

States With An Inheritance Tax Recently Updated For 2022 Jrc Insurance Group

Estate Taxes In Phoenix Arizona Az

States With Estate Tax Or Inheritance Tax 2021 Tax Foundation

A Guide To Estate Taxes Mass Gov

Arizona Poised To Move To A Flat Tax Rate Beachfleischman Cpas

Even With No Estate Tax Some Tax May Be Due On Inheritance Fleming Curti Plc

Do You Report Income Tax On An Inheritance In Arizona